INTRODUCTION

The past few months have been tough for us as a country, and I wish all the strength to people who have suffered a loss. Trapped in isolation, I decided to inculcate the habit of book reading, which I’ve meant to for a long time, but as they say, ‘The beginning is the hardest part.’ I find Behavioral Economics quite an interesting domain and would like to discuss the concept of Moral Hazard, which we’ve all witnessed around us in some way or another.

Moral Hazard describes a situation in which one person decides how much risk to take, while someone else bears the cost if things go badly. As a result, the entity which does not have to bear the cost associated with his actions is likely to behave recklessly.

Let’s try to understand this with some examples.

MORAL HAZARD OCCURRENCE

The most common occurrence of Moral Hazard is seen in the insurance industry. Someone who has fire insurance for his house can act carelessly about fire hazards like not installing the fire alarms. This creates a moral hazard for insurance companies. Essentially the risk is not just transferred to the other party, but it may even increase.

Situations of Moral Hazard can arise in business. Suppose a company appoints a CEO. He is not the company's owner, and his pay depends on the company’s performance in the upcoming year. This means he has a great incentive to take risky decisions, which will boost the company in the short term but will be harmful to the company in the long term.

A good case would be, The CEO sees that the revenue of the company is dropping. In a bid to improve performance, he decides to cut prices. This leads to improved revenue for the company in the short term. But what he hasn’t thought through is, What if the competitors cut prices? What if the price cuts reduce the Brand Value? These factors may hurt the company in the long term.

MORAL HAZARD IN THE GLOBAL FINANCIAL CRISIS

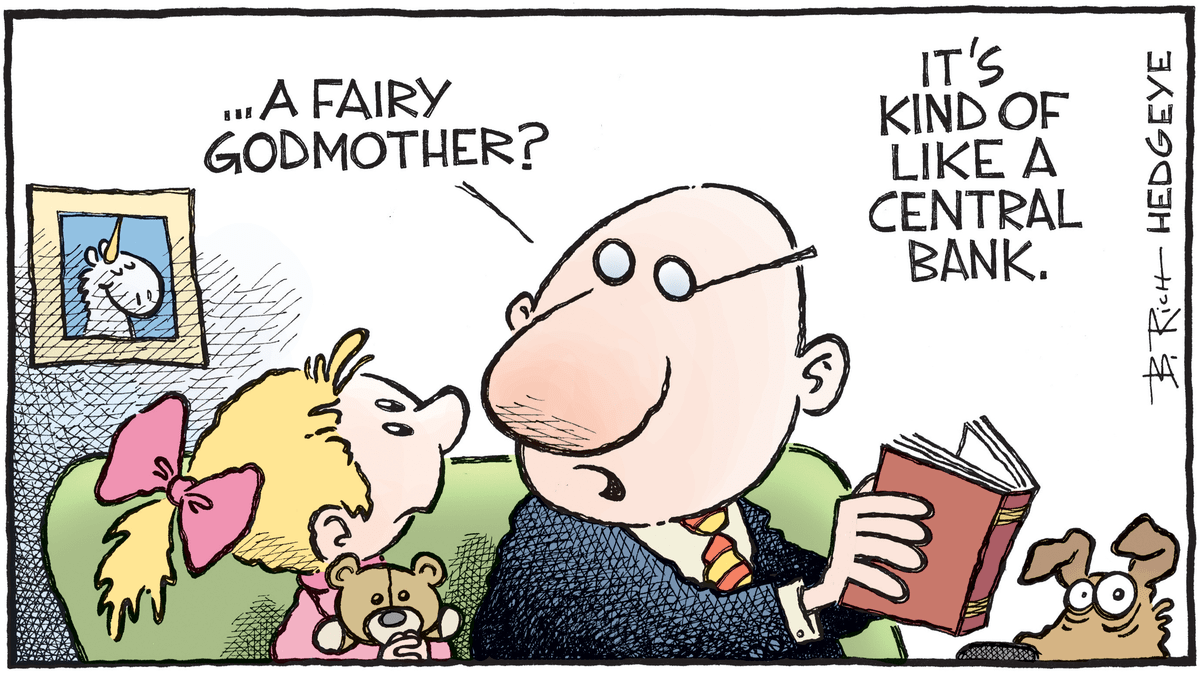

Many scholars and journals cite Moral Hazard as a key reason for the Global Financial Crisis of 2008, and it is easy to back their reasoning. When Bankers bundle bad loans as securities (Mortgage Backed Securities) to other investors, they aren’t exposed to risk. The banker is paid for making the deal, and it isn’t his concern if the borrower will repay the loans. Several Banks thought they were ‘Too Big to Fail,’ believing they were essentially invincible to failure, thus putting them in a position of moral hazard: they could take on big risks thinking that the federal government would bail them out in the event of a major failure.

The 2008 crisis was a moral hazard created due to factors like these.

MITIGATION AND CONCLUSION

There is no straightforward solution to this complex problem. But the incentives have to be redesigned so that no person must be in a situation to gain upside without sharing the downside. We need people to have their ‘skins in the game.’ After the Global Financial crisis, Warren Buffet was very critical of the banks and demanded forfeiting the Net Worth of the CEO of banks who have to turn to the government for help.

Moral Hazard is an interesting phenomenon, and the only solution to this is to have more ‘Skin in the game’. If you look around, there are multiple real-life examples, notably the Indian Government Bailouts of Banks and PSUs.

Share this article if you found it interesting and shareworthy.

Subscribe to the Generalist’s Perspective for commentaries on interesting topics like this.